President Bola Tinubu has signed four landmark tax reform bills into law, marking a significant step in overhauling Nigeria’s fiscal landscape.

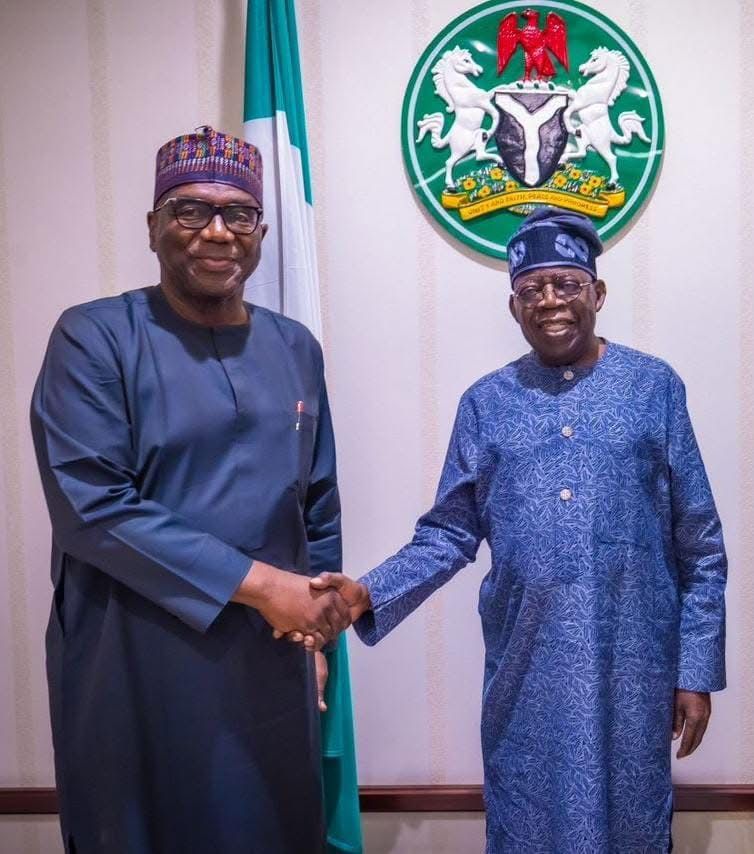

The signing took place on Thursday at the State House in Abuja, in the presence of key stakeholders from various arms of government.

The new laws include the Nigeria Tax Law, the Nigerian Tax Administration Law, the National Revenue Service (Establishment) Law, and the Joint Revenue Board (Establishment) Law.

Earlier in the day, President Tinubu explained that the new legislation would unify Nigeria’s fragmented tax system, eliminate redundancy, boost investor confidence, enhance transparency, and foster coordinated efforts across all levels of government.

Describing the reforms as a clear departure from past policies, Tinubu said they are aimed at easing the burden on working families, small businesses, and low-income earners, while eliminating long-standing inefficiencies in Nigeria’s tax structure.

In a post on his verified X handle, @officialABAT, the President noted: “We are also building a framework for the Nigeria of tomorrow—leaner, fairer and laser-focused on unlocking opportunities for all.”

He emphasized that the reforms lay the foundation for a fair, transparent, and modern tax regime that supports Nigeria’s development goals.

“These reforms go beyond streamlining tax codes. They deliver the first major, pro-people tax cuts in a generation—targeted relief for low-income earners, small businesses, and families working hard to make ends meet.

“For too long, our tax system has been a patchwork—complex, inequitable, and burdensome. It has weighed down the vulnerable and shielded inefficiency. That era ends today.

“We are laying a foundation for a tax regime that is fair, transparent, and fit for a modern, ambitious Nigeria. A tax regime that rewards enterprise, protects the vulnerable, and mobilizes revenue without punishing productivity,” he added.

Leave a Reply